Lithium is the critical raw material for electric vehicles and energy storage systems, but a failure of investment in new supply in previous years is likely to leave a structural deficit for the rest of this decade, data on expected supply against expected demand (both until 2030) shows.

During the latest lithium price bear cycle, which lasted from mid-2018 and mid-2020, the investment from the specialty chemical shrank. A couple of months into 2018, quite a bit of new spodumene ore capacity began ramping up from prior investments made in advance of an anticipated EV boom that never commenced until H2 2020, and the oversupply drove prices into the ground and capped investments.

This time around, it’s a completely different story, with demand strong and growing far more quickly than supply. EVs represented nearly 20% of new car sales in China and more than 25% in the European Union in recent months, pressuring suppliers to attempt to quicken expansion and new projects. Financing and permitting are, however, seen as big hurdles.

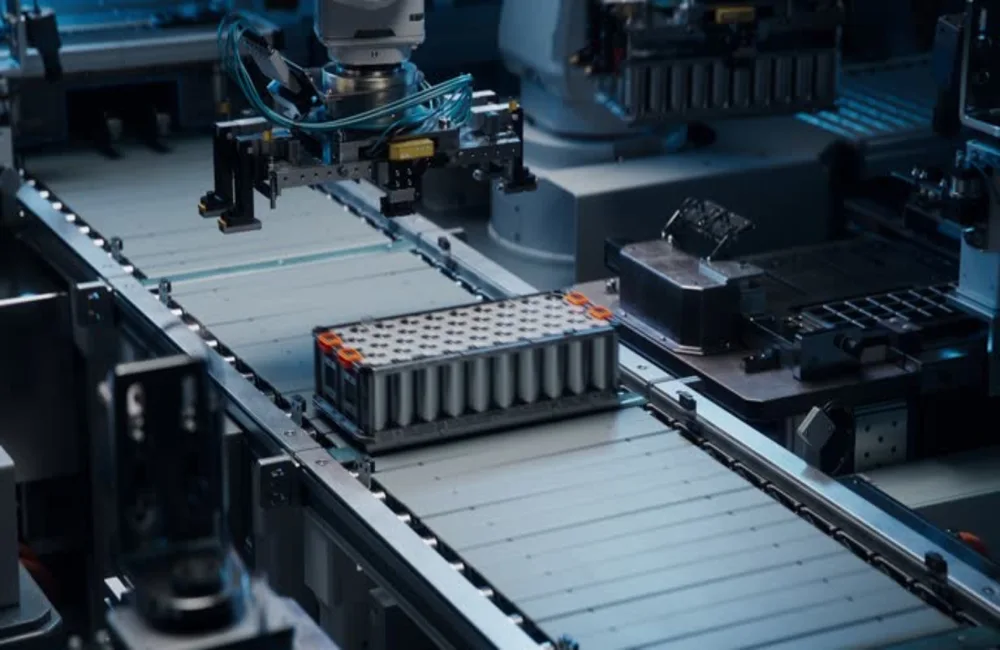

While the battery industry has been pouring big investment into downstream battery capacity to supply the booming EV demand, lithium is still receiving much less funding than it needs, and the investment might also be too little too late to forestall a structural shortage in the next few years.

“Sadly, battery capacity can outbuild lithium projects by quite a bit,” said Joe Lowry, president of the consulting firm Global Lithium. “Underinvestment in lithium capacity over the last five years will prolong the supply shortfall.”

Things are so challenging that Lowry was unwilling to make demand projections past 2027, the imbalance between supply and demand could be severe enough that supply could end up constraining demand, making any forecast beyond that point potentially meaningless, he said.

“Even the well-capitalized major lithium companies have found it difficult to meet their expansion plan targets,” Lowry said. “Covid and associated supply chain problems pushed out the timelines of many new producers, and similar OEMs and battery producers had relied on ‘market forces’ to generate sufficient battery raw materials supplies, belatedly they are taking notice of the supply-demand crisis but well too late for a solution in the near to mid term. The picture painted by Lowry is borne out by Platts' comparison of the supply expected and demand expected out to 2030 (graphic below), which shows supply should fall well short of meeting the projected demand of 2 million mt by the end of the decade. To perform the analysis, Platts segmented the projects into three tiers based on when they were expected to achieve nameplate capacity.

Carbonate vs hydroxide

Despite the growing demand for lithium hydroxide needed for nickel-rich battery chemistries, that have a higher energy density (to enable EVs to cover longer distances at a single charge), most of the integrated capacity available in the current market is focused on lithium carbonate.

While even more greenfield projects some of which will use brines that for whatever reason must at the outset be producing carbonate that will include hydroxide conversion will likely be expected going forward, and most of the hard rock supply is being directed to hydroxide use, the carbonate itself will still make up a large percentage of the supply while hydroxide production will be dependent on adequate raw material supply for conversion.

Limits to feedstock (typically spodumene) should be a worry for any number of non-integrated conversion capacity projects, most of which are targeting hydroxide. Adding conversion capacity is less capital-intensive, and bear in mind it is faster than building the underlying feedstock capacity, which means there is a potential mismatch and could leave some hydroxide converters with idled capacity despite soaring demand, the sources said.

A few projects will also have the ability to produce either carbonate or hydroxide depending on the market conditions. With the new leaps in the demand for battery chemistries that are nickel-free, with official announcements from companies like Tesla and Volkswagen, it is very likely that the demand for lithium carbonate will remain healthy during this decade.

There are also new kinds of assets, that were never developed before such as clay and geothermal brines that should mark the second generation of lithium projects, along with direct lithium extraction (DLE) technology. Most of these will also aim to increase the integrated hydroxide capacity, but still need to demonstrate commercial viability.

DLE has been hyped by some as the holy grail for the lithium industry, producing better quality products at a faster rate, at a lower cost, and with less water use. Others, though, are insistent that DLE is not a one-size-fits-all approach to applying in all projects and also that it hasn’t been commercially proven at scale, so its success to this point has not been proven.